Kingsford

Charcoal Case Study Solved

Executive

Summary

This document presents analysis

of the case “Kingsford Charcoal.” Kingsford Charcoal is facing a decline in its

sales growth in 2000. Kingsford’s market share in the charcoal has increased

relative to its closest competitors—Royal Oak and private label brands. However,

its growth in total sales has seen a decline due to shrinkage in charcoal

grilling category and customers switching towards gas grilling.

Kingsford’s brand team

has a few options at their disposal to revive the growth: revise prices which

they haven’t done in past several years; increase advertising to expand

charcoal category pie; extend grilling season by adding new occasions; use

promotions to partner with channels to encourage impulse buying; and finally,

use a combination of these strategies to achieve the objective. Combination of

advertising and promotions has been suggested. First, because recent price

increases by Royal Oak and private labels have driven away customers from

charcoal to gas grilling. Second, advertising can help change customers’

attitude, it can promote charcoal grilling as a natural and tasty way of

grilling. Last, promotions can win channel support to provide discounts beyond

the traditional summer grilling season.

First section of this

document focuses on defining the problem and states the alternative solutions. The

second part analyzes the alternatives in detail by performing quantitative and

qualitative methods. It also comments on each solution’s feasibility and

long-term implications. While the third section lays out the implementation plan

for the chosen strategy.

Problem

statement

Kingsford charcoal is a charcoal

brand. Charcoal is used for grilling as an alternative to gas grilling. There

are two methods of grilling: charcoal grilling and gas grilling. Gas grilling

penetration has been historically slightly higher than charcoal grilling (Exhibit

6 in the case). Although charcoal grilling takes more time and effort to burn,

most die-hard fans of grilling prefer it as a natural, suitable, and tastier

way to grill. Therefore, the customers who use charcoal grilling are very loyal

to the method. Kingsford has

traditionally leveraged this attitude amongst Americans by providing superior

quality charcoal at premium prices. However, the recent development is that gas

grilling category’s sales are increasing (8% growth in 2000) while charcoal

grilling category’s sales are declining (3% drop in the same year). As a result

of decreasing pie for the charcoal grilling, Kingsford’s sales growth has

started declining (See Exhibit 3 in the case) despite growth in its market

share relative to its close competitors Royal Oak and Private label brands.

Thus, the challenge is:

how to regain growth in revenue from charcoal, and expand the pie of charcoal

grilling as a whole while also remaining in the budget of not more than $7

million.

There are four

alternative areas where action can be taken to further the mentioned objective:

pricing, promotion, advertising, and any combination of two or more among

three.

First, prices are the

handiest of the tools available. For several years, Kingsford hadn’t increased

prices of its products. Now that both private labels and Royal Oak have

increased prices, should Kingsford too? The payoff will be increase in the

revenues. But costs will come terms of customers switching to competitors or

worse even to gas grilling which Kingsford isn’t in position afford. One reason

to expect the latter is the recent association between price surges by

Kingsford’s competitors and customers’ switching towards gas grilling.

Second, advertising could

help the brand stand out as a classic representative of grilling, the pure and

natural way of grilling—with charcoal. Although Kingsford spends more on

advertising than do its competitors, its advertising spending has declined over

the past 5 years from $6 million to just one million. While advertising

spending has been increasing advertising spending during the same period.

Therefore, there seems more attraction towards this alternative. Moreover,

co-adverting activities are common when increasing category share is the target.

Third, promotions are one

thing Kingsford has more focused on in the past. This time, it is an option

too. But promotions were a successful strategy to gain channel support mostly

to wipe out competitors and not gas grilling. However, one attractive feature of this alternative

is partnering with the channel to create promotions which could stretch the

grilling season from a summer-oriented hobby to broader passion which

encompassed sports.

The last, decision

alternative is a combination of these three. Slightly increasing prices within

customers’ just noticeable difference supported by advertising should help

prevent customers from switching to competition or gas grilling. While,

partnering with channels to offer discounts in newer occasions candidates for

grilling, for example NASCAR, coupled with advertising focused mainly on ‘why

charcoal grilling is better than gas grilling’ seems to be even better option.

In the next section, we analyze each alternative in detail.

Analysis

of alternatives

Pricing

Price elasticity what-if

analysis (Exhibit 10 in the case) provides us with the expected pay offs and

probabilities of different outcomes corresponding to different levels and types

of price changes.

Price increases usually result

in withdrawal of support from retailers because price increases can turn

profitable customers away from a store. So, here we analyze how each price

increase affects merchandising.

Frist, if the price are

increased by 4% across Club/Home centers, three possible scenarios can occur:

no merchandising loss resulting probable pay off of $648; 300 Msc loss at

Costco with resulting payoff of only $0; and loss of 1000 Msc at Costco

resulting in a loss of ($375). Therefore, the net payoff of this will be $283.

(Exhibit 1 panel (1))

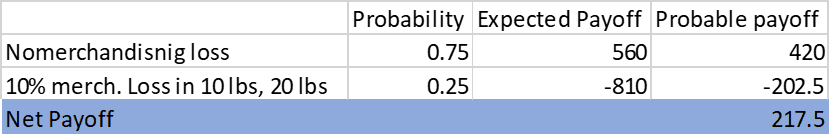

On the other hand, if price

of Blue Bag were given minimal raise (2.5%), either no merchandising loss would

be incurred (75% probability), or 10 of merchandising would be lost on 10 and

20 lbs. bags (25% probability). The resulting net payoff would be $217.5

(Exhibit 1 panel (2)).

Third a higher (5%) Blue

Bag price increase would either result in no merchandising loss and generating

$535, or 7% merchandising loss in of 10 and 20lbs. bags generating only $55. The

resulting net payoff will be $585 (Exhibit 1 panel (3))

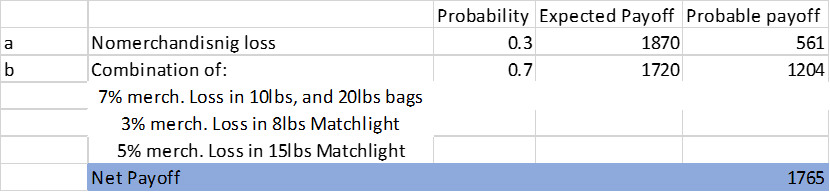

Lastly, a total line

pricing increase of 5% would either result in no merchandising loss, which is

only 30 percent likely and generates $561; or a combination of merchandising

losses in different SKUs still generating $1204. Thus, total line increase of 5%

results in net benefit of $1765 (Exhibit 1 panel (4)).

Now if we analyze, this

last option is best of all. However, a mere price increase would result in long-term

switching from charcoal grilling towards gas grilling. There is substantial

number of customers who are not loyal to any brand or charcoal grilling.

Therefore, a price increase without support of advertising is not a profitable

move.

Advertising

If total $6 million are

to be spent on advertising in 2001, assuming advertising has the same effects

as in 1998, it would generate incremental volume both in 2001 and 2002.

Additional fund required would be $5,000,000 and the accrued benefits would

total $12.3 million. A net benefit of $7.3 million in sales at the static

prices of 1999. (For a detailed calculation, see Exhibit 2 in Appendix 1).

Besides these dollar-benefits, advertising could hit the real root of the

problem: change attitudes about “gas vs. charcoal grilling” in the favor of the

latter. Because charcoal category advertising has been continuously declining

over the past few years while the same for gas grilling has been increasing,

the switching behavior maybe associated to the increased advertising by the gas

grilling category brands. Moreover, comarketing efforts can also expand the pie

by increasing the number of grilling occasions.

Advertising message would

need to be adjusted if the objective is to promote charcoal over gas grilling. Specifically,

the message “lights twice as fast as other coals” was irrelevant in this case

because customer were now comparing coal with gas not coal with different coal.

Further, because the objective was to hit gas grilling, convenience and fast

lighting feature was to be highlighted and at least parity with gas grilling

should be achieved to stay relevant. As segmentation study showed Kingsford’s

consumers consuming regular were more fond of charcoal grilling. Finally, care

should be taken not to distort the original older associations with natural,

and tasty. Otherwise brands identity would be hurt and even loyal customers

might turn away.

Promotions

Besides all the regular

benefits of promotions to the sales of Kingsford, promotions are very crucial

tool to extend grilling occasions beyond summer season. One new occasion to turn

into a grilling event is NASCAR which. Promotions could increase impulse

purchase by attractive and appropriate displaying locations, they can increase

trial on new occasions. In 2001, Kingsford’s promotional expenditure is

estimated to be $39 million in terms of forgone revenue from price reductions—US

$31 million—and sales promotions in terms of coupon redemptions—US $8million.

If additional dollars are

expended on promotions, they might generate no benefit without advertising and

bringing in new customers. Therefore, it is advisable to marry a combination of

advertising and promotions. Price increases will drive customers away from

charcoal category and cause Kingsford to lose channel support; given the

objective of expanding the charcoal category, this strategy seem incompatible.

Thus, the best of available alternatives is a combination of advertising and

promotions. It may seem to be just a cost driver, but in fact it is an

investment that will pay off. One drawback of this strategy would be that other

charcoal brands might free ride the expansion of charcoal category. However, if

designed carefully, advertising can strongly associate Kingsford (and only it)

with charcoal that it might prevent new customers from going to Royal Oak and

private labels.

Plan

Development

Now that we have decided

to use a combination strategy of advertising and promotions, we need to develop

a plan of implementation of this strategy. We start with prices under this new

strategy.

Prices

As we saw in the analysis

section that price increases would result in higher revenues for the immediate

periods, but we also stated that they would adversely impact the charcoal

category hence Kingsford’s performance which holds more than 50 percent of the

category. Therefore, in the initial phases as strategy become effective, prices

remain at the same level (except for discounts).

Placement

and Promotions

Placements are ensured at

the same retailers but at the central Walmart stores a minimum of 5000 pounds

is met by providing trade allowance to the retailer on Labor Day and then Memorial

Day. Moreover, merchandize will be optimized using MAPS formula used by the

company. $2 million additional will be spent on promotions at new occasions

including NASCAR, since expected budget is $7 million and $5 million are

dedicated to advertising.

Advertising

and Message

The

new advertising message for regular charcoal would be “grill as fast as gas”

and “taste as great as charcoal.” This message highlights the superiority of

charcoal grilled food’s taste (blind taste test has already supported this hypothesis)

while tells that with Kingsford’s charcoal, convenience is not less than gas

grilling. So, the net perceived benefit to the customer is greater and there is

incentive to switch from gas to charcoal grilling. If prices are controlled for

some time this advertising, Kingsford can become leader in grilling not only in

charcoal. Therefore, as we saw while analyzing costs and benefits of

advertising, volume increases will be the return on this investment. And once attitudes

attitudinal loyalty is achieved, price premiums can become justifiable.

Production

capacity

Production capacity

decisions usually lie beyond the scope of brand teams. However, to support

growth and investment in the brand with seamless supply brand teams need to recommend

and forecast timely decisions for supply chain and production adjustments. If

this plan is sustained for three consecutive years and 7% volume growth in 2001

3-4% in 2002, plants will be operating at their full capacity in three years. Given

that building a new plant can take up to five years to be operational, a

capacity increase is recommended by now.

Appendix 1 Exhibits

Exhibit 1: Net payoffs ($) of the proposed price changes

0 Comments

Please share views in the comments.